software for

data-driven traders

The backtesting or analysis library that's right for you depends on the style of your trading strategies. End of day or intraday? 8 symbols, or 8000? Event-driven or factor-based? QuantRocket supports multiple open-source Python backtesting and analysis libraries. Or, plug in your own custom scripts and tools thanks to QuantRocket's modular, microservice architecture.

The popular backtester that originally powered Quantopian

Key features:

import zipline.api as algo

def initialize(context: algo.Context):

context.assets_to_buy = []

# Rebalance every day, 30 minutes before market close.

algo.schedule_function(

rebalance,

algo.date_rules.every_day(),

algo.time_rules.market_close(minutes=30),

)

def rebalance(context: algo.Context, data: algo.BarData):

positions = context.portfolio.positions

# Exit positions we no longer want to hold

for asset, position in positions.items():

if asset not in context.assets_to_buy:

algo.order_target_value(asset, 0, style=MarketOrder())

...

See Zipline code examples or read the Zipline docs

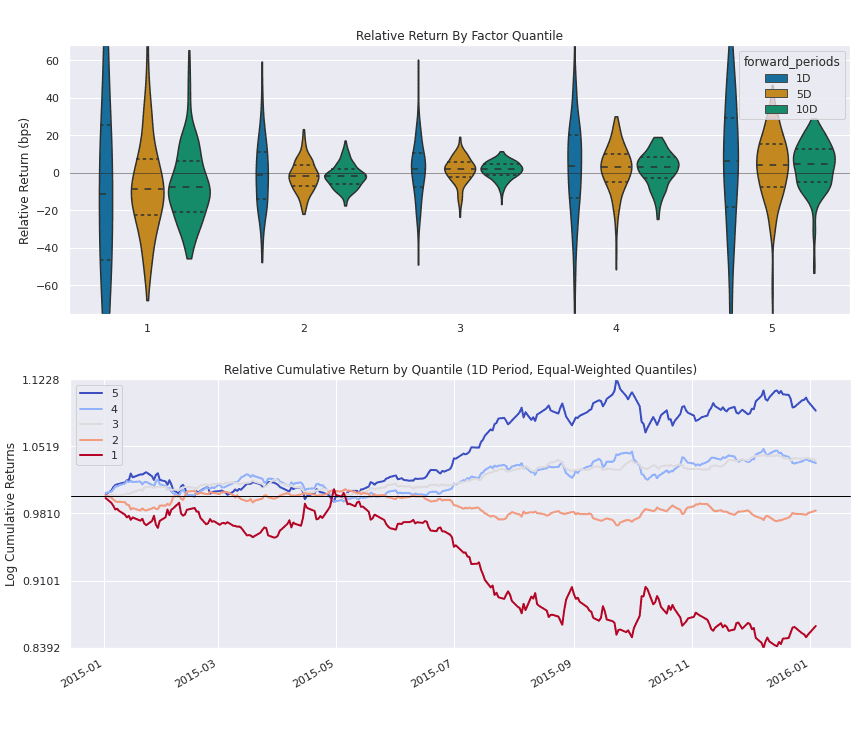

Screen and analyze large universes of securities with Pipeline

Key features:

from zipline.pipeline import sharadar

# trailing-twelve month fundamentals

fundamentals = sharadar.Fundamentals.slice("ART")

# create a universe of the top 50% of stocks by market cap

# that also pay dividends

liquid_stocks = fundamentals.MARKETCAP.latest.percentile_between(50, 100)

pay_dividends = fundamentals.DIVYIELD.latest > 0

universe = liquid_stocks & pay_dividends

# Select the cheapest 100 stocks by enterprise multiple from among

# the universe of liquid, dividend-paying stocks

enterprise_multiple = fundamentals.EVEBITDA.latest

stocks_to_buy = enterprise_multiple.bottom(100, mask=universe)

See Pipeline code examples or read the Pipeline docs

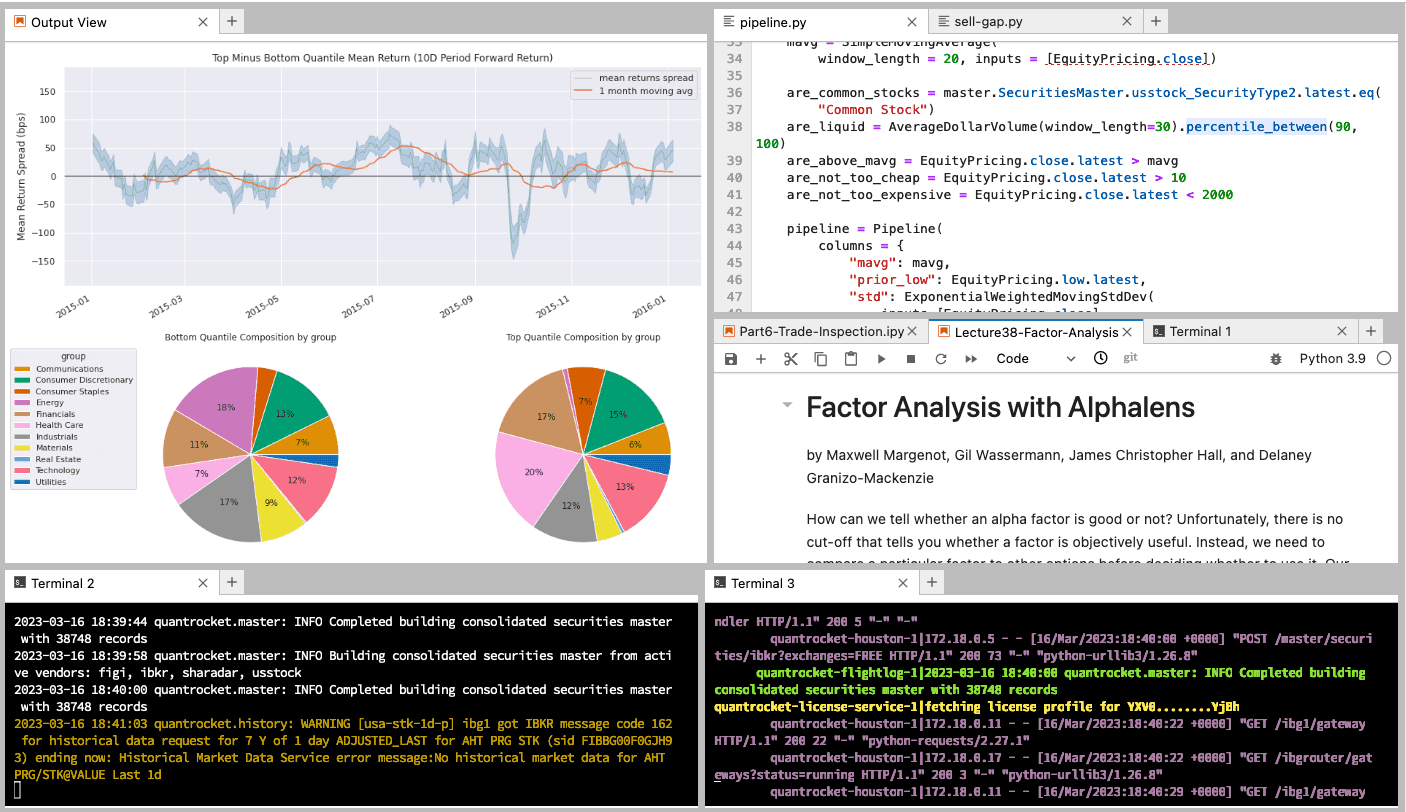

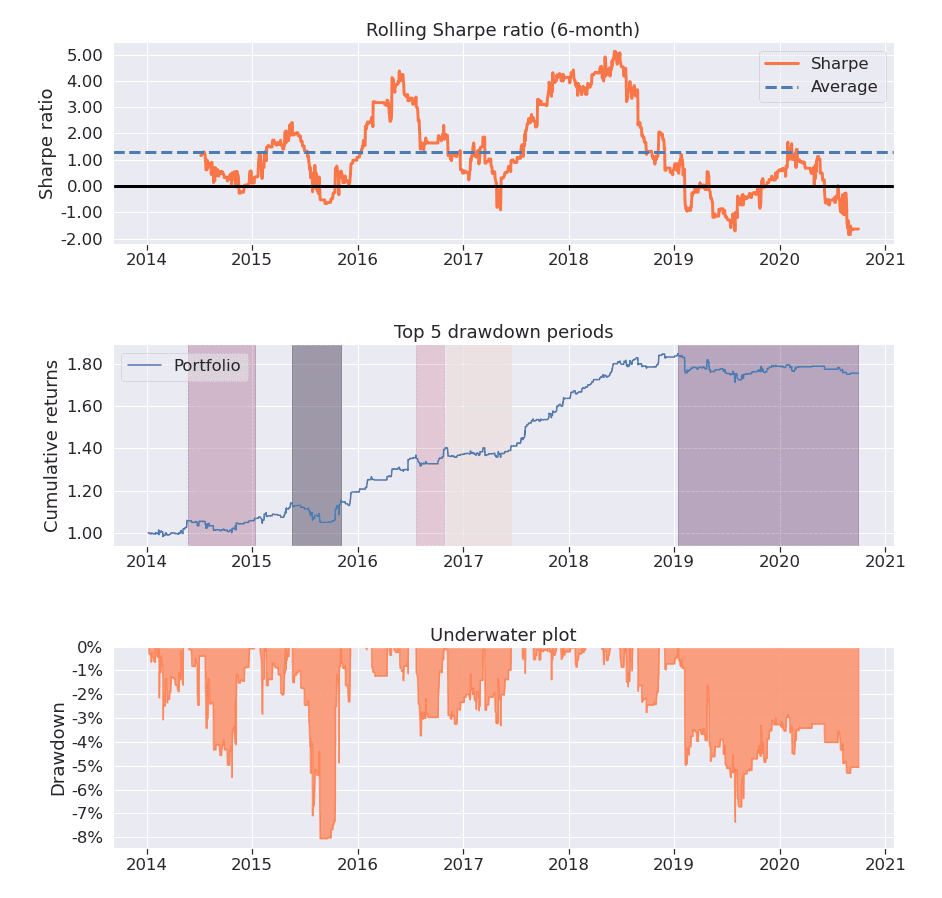

Quickly analyze the predictive value of alpha factors with Alphalens

Key features:

See Alphalens code examples or read the Alphalens docs

Moonshot is the backtester for data scientists

Key features:

import pandas as pd

from moonshot import Moonshot

class MovingAverageStrategy(Moonshot):

CODE = "demo-50ma"

DB = "demo-stk-1d"

def prices_to_signals(self, prices: pd.DataFrame):

# Buy when the close is above the 50-period moving average.

closes = prices.loc["Close"]

mavgs = closes.rolling(50).mean()

signals = closes > mavgs.shift()

return signals.astype(int)

See Moonshot code examples or read the Moonshot docs

First class support for machine learning strategies with MoonshotML

Key features:

import pandas as pd

from moonshot import MoonshotML

class DemoMLStrategy(MoonshotML):

CODE = "demo-ml"

DB = "demo-stk-1d"

def prices_to_features(self, prices: pd.DataFrame):

closes = prices.loc["Close"]

features = {}

# use past returns...

features["returns_1d"]= closes.pct_change()

# ...to predict next day returns

targets = closes.pct_change().shift(-1)

return features, targets

def predictions_to_signals(self, predictions: pd.DataFrame, prices: pd.DataFrame):

# buy when the model predicts a positive return

signals = predictions > 0

return signals.astype(int)

See MoonshotML code examples or read the machine learning docs

Run custom scripts or connect third-party backtesters

A hint of what's possible:

import backtrader as bt

class DualMovingAverageStrategy(bt.SignalStrategy):

params = (

('smavg_window', 100),

('lmavg_window', 300),

)

def __init__(self):

# Compute long and short moving averages

smavg = bt.ind.SMA(period=self.p.smavg_window)

lmavg = bt.ind.SMA(period=self.p.lmavg_window)

# Go long when short moving average is above long moving average

self.signal_add(bt.SIGNAL_LONG, bt.ind.CrossOver(smavg, lmavg))

See a complete example or read the custom scripts docs

Most quants spend 80% of their time wrangling data and only 20% doing research.

QuantRocket puts a wealth of global market data at your fingertips so you can focus on analysis.

What will you ask the data?

>>> prices = get_prices('us-stk-1d').loc["Close"]

>>> sectors = get_securities_reindexed_like(prices, fields=["Sector"]).loc["Sector"]

>>> eps = get_sharadar_fundamentals_reindexed_like(prices, fields=["EPS"]).loc["EPS"]

>>> eps.groupby(sectors).mean()>>> prices = get_prices("us-stk-1d").loc["Close"]

>>> borrow_fees = get_ibkr_borrow_fees_reindexed_like(prices)

>>> borrow_fees.where(prices < 1).rank(axis=1)>>> at_close = prices.xs("16:00:00", level="Time")

>>> near_close = prices.xs("15:30:00", level="Time")

>>> is_up_for_session = (near_close - at_close.shift()) / at_close.shift()

>>> last_half_hour_returns = (at_close - near_close) / near_close

>>> last_half_hour_returns.where(is_up_for_session)>>> cl_prices = get_prices("cl-fut-1min", times="14:00:00").loc["Close"]

>>> gold_prices = get_prices("us-stk-1d", sids="FIBBG000CRF6Q8").loc["Close"]

>>> contract_nums = get_contract_nums_reindexed_like(cl_prices, limit=2)

>>> month_1_prices = cl_prices.where(contract_nums==1).mean(axis=1)

>>> month_2_prices = cl_prices.where(contract_nums==2).mean(axis=1)

>>> cl_in_contango = month_2_prices > month_1_prices

>>> gold_prices.where(cl_in_contango)Find your data in the Data Library

QuantRocket's home base is JupyterLab, the IDE of choice for data scientists. (VS Code is also supported.)

Comprehensive hover documentation with auto-complete is available for all of QuantRocket's APIs.

Real-time market data, powered by your choice of provider.

An intuitive API with a flexible feature set, powered by QuantRocket.

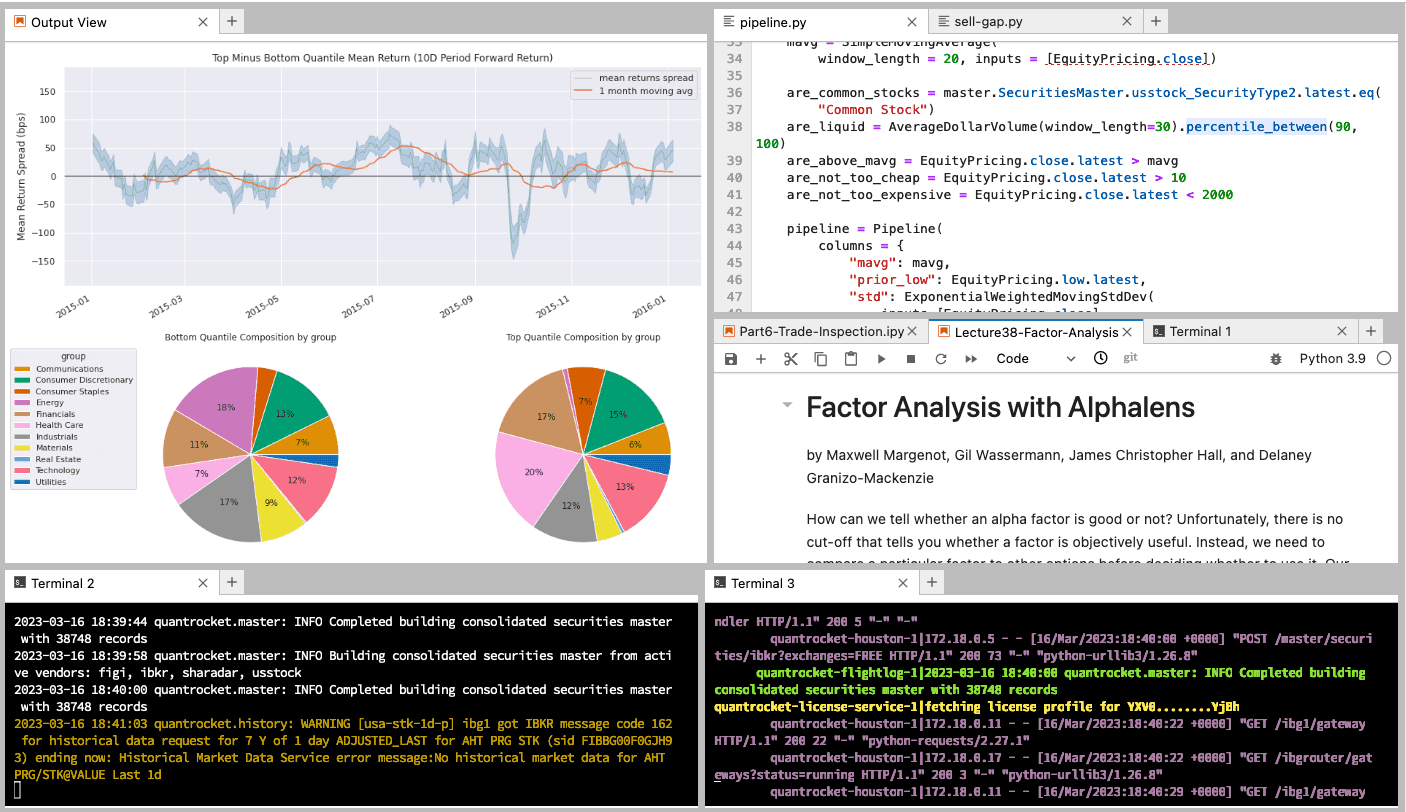

Backtesting is only the first step. Once you go live, you need a clear picture of performance to assess whether live trading is mirroring your backtest.

Find more example strategies in the Code Library